Starting with the topic of best mortgage refinance rates 2025, this paragraph aims to draw in the readers with valuable insights and information.

Exploring the importance of securing the best rates for your mortgage refinance in the upcoming year can ultimately lead to significant savings and financial stability.

Importance of Mortgage Refinance Rates

When it comes to homeownership, mortgage refinance rates play a crucial role in determining the overall cost of a loan. These rates can have a significant impact on monthly payments and the total amount of interest paid over the life of the loan.

Saving Money with Lower Rates

Lower mortgage refinance rates can lead to substantial savings for homeowners in the long run. For example, reducing the interest rate by just a percentage point can result in thousands of dollars saved over the life of the loan. This means more money in your pocket and less going towards interest payments.

Impact on Monthly Mortgage Payments

Interest rates directly affect the amount of your monthly mortgage payments. Higher rates mean higher payments, while lower rates can help decrease your monthly costs. By refinancing at a lower rate, homeowners can potentially lower their monthly payments, making homeownership more affordable and freeing up funds for other expenses.

Factors Influencing Mortgage Refinance Rates

When considering mortgage refinance rates, it’s essential to understand the key factors that can influence these rates. Economic conditions, credit scores, and other variables play a significant role in determining the interest rates offered by lenders.

Economic Conditions

Economic conditions such as inflation, unemployment rates, and overall market trends can have a direct impact on mortgage refinance rates. For example, during times of economic uncertainty, lenders may increase rates to mitigate risks associated with lending. On the other hand, a stable economy with lower inflation rates may lead to lower refinance rates as lenders compete for borrowers.

Credit Scores

Credit scores are another crucial factor that can influence mortgage refinance rates. Borrowers with higher credit scores are generally considered less risky by lenders and therefore qualify for lower interest rates. On the contrary, individuals with lower credit scores may face higher refinance rates or even struggle to qualify for a refinance loan at all. It’s important for borrowers to maintain a good credit score to secure the best possible rates when refinancing their mortgage.

Trends in Mortgage Refinance Rates

The mortgage refinance rates have always been subject to various trends influenced by a multitude of factors. Understanding these trends is crucial for homeowners looking to refinance their mortgages.

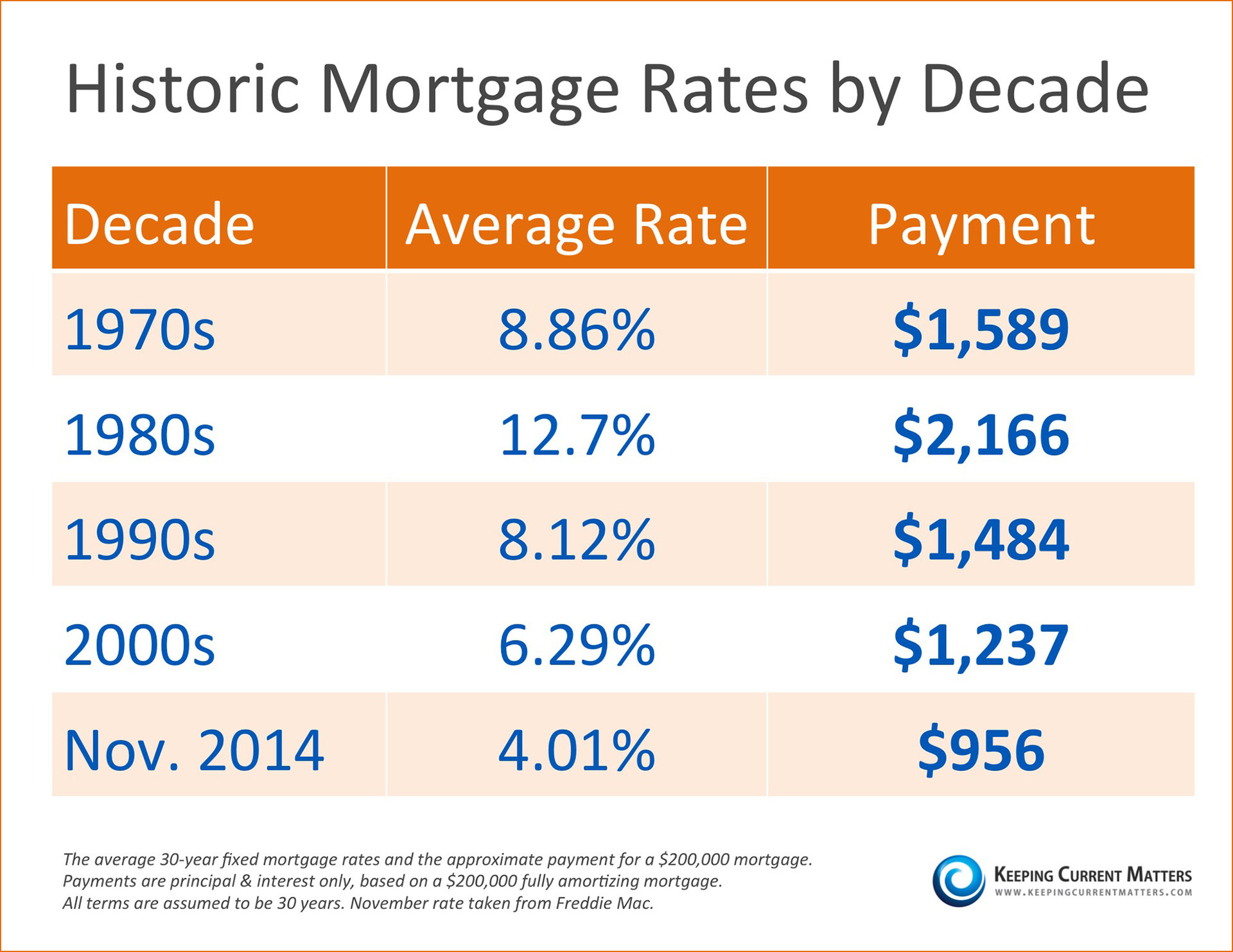

Historical data shows that mortgage refinance rates have fluctuated over the years in response to changes in the economy, housing market conditions, and government policies. For example, during times of economic uncertainty, such as the 2008 financial crisis, mortgage refinance rates tend to decrease as the Federal Reserve lowers interest rates to stimulate the economy.

Global events can also have a significant impact on mortgage refinance rates. For instance, geopolitical tensions, natural disasters, or pandemics can lead to increased volatility in financial markets, causing mortgage rates to rise or fall unpredictably.

Looking ahead to 2025, projections suggest that mortgage refinance rates may continue to remain at historically low levels due to ongoing economic recovery efforts and the Federal Reserve’s commitment to maintaining a accommodative monetary policy. However, unforeseen events or policy changes could potentially alter these projections.

Impact of Global Events on Mortgage Refinance Rates

Global events such as trade wars, geopolitical conflicts, or natural disasters can create uncertainty in financial markets, leading to fluctuations in mortgage refinance rates. These events can cause investors to seek safe-haven assets, affecting bond yields and ultimately influencing mortgage rates.

Projections for Mortgage Refinance Rates in 2025

Experts predict that mortgage refinance rates in 2025 are likely to remain relatively low compared to historical averages. This is primarily due to the Federal Reserve’s commitment to keeping interest rates low to support economic growth. However, unforeseen events or changes in economic conditions could potentially impact these projections.

Finding the Best Mortgage Refinance Rates

When looking to refinance your mortgage, finding the best rates is crucial to saving money in the long run. Here are some tips on how to find the best mortgage refinance rates.

Compare Different Lenders and Their Rate Offerings

When searching for the best mortgage refinance rates, it’s important to compare offerings from different lenders. Each lender may have different rates and terms, so shopping around can help you find the most competitive option. Consider both traditional banks and online lenders to get a comprehensive view of what’s available in the market.

Importance of Shopping Around for Rates

Shopping around for mortgage refinance rates is essential because even a small difference in interest rates can lead to significant savings over the life of your loan. By comparing rates from multiple lenders, you can ensure that you’re getting the best deal possible and not overpaying on your mortgage.

Consider Different Loan Terms

In addition to comparing interest rates, it’s also important to consider different loan terms when refinancing your mortgage. Shorter loan terms may come with lower interest rates but higher monthly payments, while longer loan terms may have higher interest rates but lower monthly payments. Assess your financial situation and long-term goals to choose the right loan term for you.

Check Your Credit Score

Your credit score plays a significant role in the interest rate you’ll be offered when refinancing your mortgage. Before applying for a refinance, check your credit score and take steps to improve it if needed. A higher credit score can help you qualify for lower interest rates, saving you money over the life of your loan.

Fixed vs. Adjustable Rate Mortgages

When it comes to choosing between fixed and adjustable rate mortgages for refinancing, it’s important to understand the key differences and weigh the pros and cons of each option.

Fixed Rate Mortgages:

Pros and Cons of Fixed Rate Mortgages

- Pros:

Provides stability and predictability in monthly payments

Interest rate remains constant throughout the loan term

- Cons:

Initial interest rates may be higher compared to adjustable rate mortgages

Less flexibility if market interest rates decrease

Adjustable Rate Mortgages:

Pros and Cons of Adjustable Rate Mortgages

- Pros:

Initial lower interest rates may result in lower initial monthly payments

May benefit from decreasing market interest rates

- Cons:

Interest rates and monthly payments can increase over time

Less predictability and stability in monthly payments

Examples of Situations:

When to Choose Fixed or Adjustable Rate Mortgages

- Choose a fixed rate mortgage if you prefer stability and predictability in monthly payments, especially if you plan to stay in your home for a long time.

- Consider an adjustable rate mortgage if you expect interest rates to decrease in the future or if you plan to sell or refinance your home before the adjustable period begins.

Refinancing Strategies for Lower Rates

When looking to refinance your mortgage, there are several strategies you can employ to secure lower rates and save money in the long run. Below are some key strategies to consider:

Negotiating Lower Refinance Rates

- Shop around and compare offers from multiple lenders to leverage competitive rates.

- Highlight your strong credit score and financial stability to lenders to negotiate for better rates.

- Consider paying points to lower your interest rate, if you plan to stay in your home long enough to recoup the upfront costs.

Role of Points in Lowering Interest Rates

- Points are fees paid to the lender at closing in exchange for a lower interest rate on your mortgage.

- Each point typically costs 1% of your total loan amount and can reduce your interest rate by a certain percentage.

- Calculate whether paying points upfront makes financial sense based on your long-term homeownership plans.

Timing the Refinance for the Best Rates

- Monitor interest rate trends and economic indicators to identify the optimal time to refinance.

- Consider refinancing when interest rates are significantly lower than your current rate to maximize savings.

- Avoid waiting too long to refinance, as rates can fluctuate and potentially rise in the future.

Impact of Loan Term on Refinance Rates

When considering mortgage refinance rates, the loan term plays a crucial role in determining the overall cost of borrowing. The loan term refers to the length of time over which the loan will be repaid, typically ranging from 15 to 30 years. Understanding how the loan term affects refinance rates can help borrowers make informed decisions.

Shorter Loan Terms

Shorter loan terms, such as 15-year mortgages, often come with lower interest rates compared to longer terms. While the monthly payments may be higher, borrowers can save significantly on interest payments over the life of the loan. For example, a $200,000 mortgage at 3% interest for 15 years would have higher monthly payments but save around $50,000 in interest compared to a 30-year term.

Longer Loan Terms

On the other hand, longer loan terms, like 30-year mortgages, typically have higher interest rates but lower monthly payments. While borrowers may pay more in interest over the life of the loan, the lower monthly payments can make homeownership more affordable. For instance, a $200,000 mortgage at 4% interest for 30 years would have lower monthly payments but result in higher overall interest costs.

Impact on Monthly Payments

The choice of loan term directly impacts the monthly payments a borrower will make. Shorter loan terms have higher monthly payments but lower total interest costs, while longer terms offer lower monthly payments but higher overall interest expenses. Borrowers should consider their financial goals and budget when deciding on the loan term that best suits their needs.

Understanding Closing Costs

When it comes to mortgage refinancing, closing costs play a crucial role in determining the overall expenses involved in the process. Understanding what closing costs are and how they can impact your refinancing decision is essential to make informed choices.

Breakdown of Closing Costs

Closing costs typically include various fees and charges associated with finalizing the mortgage refinance. These can include appraisal fees, application fees, title search fees, attorney fees, and more. It is important to get a detailed breakdown of these costs from your lender to have a clear picture of what you are paying for.

Impact on Overall Cost

The closing costs can significantly add to the total amount you need to pay when refinancing your mortgage. It is crucial to factor in these costs when evaluating the benefits of refinancing to ensure that the savings you gain from lower rates are not offset by the closing expenses.

Tips for Negotiating and Reducing Closing Costs

- Shop around for different lenders and compare their closing cost estimates to find the best deal.

- Ask your lender if there are any opportunities to reduce or waive certain fees.

- Consider rolling the closing costs into your loan amount, although this may increase your monthly payments.

- Negotiate with your lender to see if they can offer you a lower rate in exchange for higher closing costs, or vice versa.

Refinance Rate Comparison Tools

When considering refinancing your mortgage, it’s essential to explore all your options to find the best rates available. This is where refinance rate comparison tools can be incredibly helpful in making an informed decision.

Using online rate comparison platforms can provide borrowers with a convenient way to compare multiple lenders and offers in one place. These tools typically allow you to input your specific financial information and loan details to receive personalized rate quotes. By utilizing these resources, borrowers can easily compare interest rates, terms, and fees from various lenders to identify the most competitive options.

Benefits of Using Refinance Rate Comparison Tools

- Save Time: Instead of reaching out to individual lenders separately, comparison tools streamline the process by presenting multiple offers at once.

- Cost-Effective: By comparing rates online, borrowers can potentially save thousands of dollars over the life of their loan by securing a lower interest rate.

- Transparency: These tools offer transparency by providing detailed information on rates, fees, and terms, allowing borrowers to make well-informed decisions.

Impact of Refinance Rates on Home Equity

When it comes to refinancing your mortgage, the interest rate you secure can have a significant impact on your home equity. Understanding how refinance rates affect home equity is crucial in making informed decisions about your financial future.

Refinance rates play a key role in determining the cost of borrowing money to refinance your home. The lower the refinance rate you can secure, the less interest you will pay over the life of the loan. This can result in more of your monthly payments going towards paying down the principal, which helps build equity in your home faster.

Relationship between Rates, Equity, and Loan-to-Value Ratio

- Refinance rates directly impact the amount of interest you pay on your mortgage, affecting how quickly you build equity in your home.

- A lower refinance rate means more of your monthly payment goes towards reducing the principal balance, increasing your home equity.

- The loan-to-value ratio, which compares the amount of the loan to the value of the property, can also impact your ability to refinance at a lower rate.

Examples of How Refinancing at the Right Rate Can Help Build Equity

- For example, if you refinance from a 4% to a 3% rate on a $300,000 mortgage, you could save over $50,000 in interest over the life of the loan, allowing you to build equity faster.

- Choosing the right refinance rate can shorten the time it takes to pay off your mortgage, increasing your home equity and financial stability.

Summary

In conclusion, being informed about the best mortgage refinance rates for 2025 is essential for homeowners looking to optimize their financial situation and secure the most advantageous rates for their mortgage.